Abbott is a global healthcare leader that helps people live more fully at all stages of life. Its portfolio of life-changing technologies spans the spectrum of healthcare, with leading businesses and products in diagnostics, medical devices, nutritionals and branded generic medicines. Our 109,000 colleagues serve people in more than 160 countries.

Abbott is a global healthcare leader that helps people live more fully at all stages of life. Its portfolio of life-changing technologies spans the spectrum of healthcare, with leading businesses and products in diagnostics, medical devices, nutritionals and branded generic medicines. Our 109,000 colleagues serve people in more than 160 countries.

100 Abbott Park Rd

Abbott Park, Illinois 60064-3500

Phone: 12246676100

www.abbott.com

https://www.investing.com/news/company-news/barclays-cuts-abbott-labs-stock-target-maintains-overweight-93CH-3389158

Dividend stocks have a proven record of stock market outperformance. For nearly 100 years, income-generating stocks on the S&P 500 have beaten non-payers. There has never been a decade when dividend stocks didn’t produce a positive return. And then we have the dividend royalty, companies that have raised their payouts the longest. These Dividend Kings have increased their dividends every year for 50 years or more without fail. Through wars, recessions and global pandemics, these businesses kept rewarding their investors for sticking by them. That doesn’t mean, however, their stocks will always go up. Economic factors and global events can temporarily slow business, causing investors to seek out faster growing stocks. But over time the Dividend Kings always rebound, explaining why they can still claim their thrones. The following are three royal dividend payers whose stocks are down 10% or more this year. You might want to consider buying these dividend stocks before they rebound once more.

Abbott Laboratories'' core business remains robust, with impressive performance across its segments. See why ABT stock is a Buy.

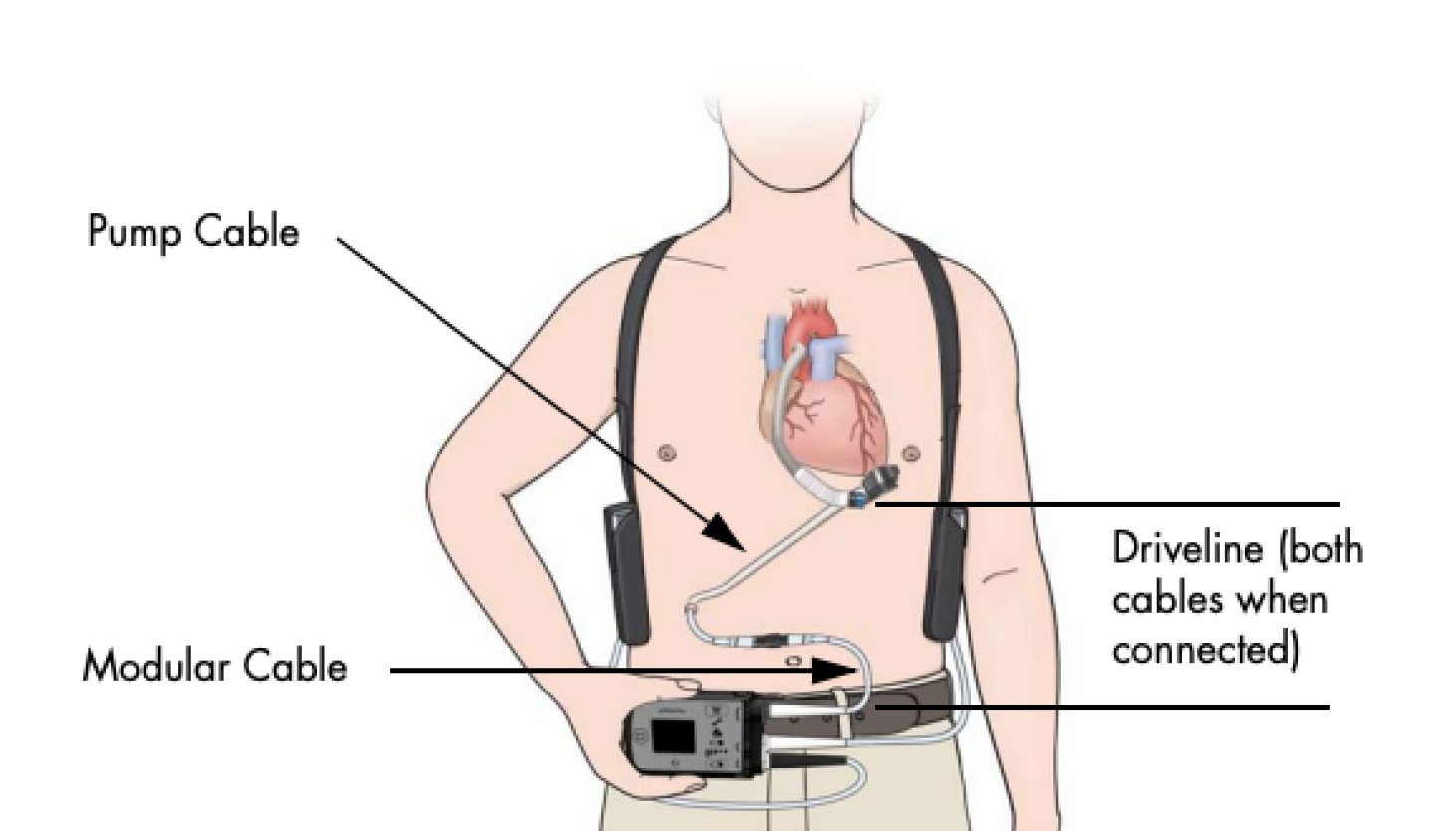

The HeartMate 3 is a mechanical pump designed for patients with end-stage heart failure and manufactured by Thoratec Corp., a subsidiary of Abbott Laboratories of North Chicago. Known as a left ventricular assist device, the HeartMate 3 helps the main pumping chamber of the heart pump blood to the rest of the body. The device can be used by patients awaiting a heart transplant or for long-term therapy. The device is powered by a cable that is attached to the pump and exits the body through a surgical opening and connects to a controller and batteries or other power source, according to the manufacturer’s instruction manual. Abbott Laboratories instruction manual A pair of heart devices manufactured by a subsidiary of North Chicago-based Abbott Laboratories has received the FDA’s most serious recall after being linked to hundreds of injuries and at least 14 deaths, the agency has announced . The recall comes years after surgeons say they first noticed problems with the HeartMate II and HeartMate 3, manufactured by Thoratec Corp., an Abbott subsidiary.

Polen Capital, an investment management company, released its “Polen Focus Growth Strategy” first quarter 2024 investor letter. A copy of the same can be downloaded here. The US stock market started 2024 optimistically. In the first quarter, the fund returned 8.29% (gross) and 8.09% (net) compared to 11.41% for the Russell 1000 Growth Index and […]

Abbott Laboratories (ABT) Q1 2024 Earnings: Exceeds Analyst Estimates and Raises Full-Year Guidance

https://www.investing.com/news/company-news/citi-maintains-stock-target-on-abbott-labs-with-buy-rating-on-strong-q1-performance-93CH-3385136

Abbott Laboratories (ABT) Q1 2024 Earnings Call Transcript Highlights: Surpassing Expectations and Raising Guidance