Intuitive, headquartered in Sunnyvale, California, is a global technology leader in minimally invasive care and the pioneer of robotic-assisted surgery. Intuitive believes that minimally invasive care is life-enhancing care. Through ingenuity and intelligent technology, it expands the potential of physicians to heal without constraints.

Intuitive, headquartered in Sunnyvale, California, is a global technology leader in minimally invasive care and the pioneer of robotic-assisted surgery. Intuitive believes that minimally invasive care is life-enhancing care. Through ingenuity and intelligent technology, it expands the potential of physicians to heal without constraints.

1020 Kifer Rd

Sunnyvale, California 94086-5301

Phone: 14085232100

www.intuitivesurgical.com

Robotics has moved far before the realm of science fiction, revolutionizing industries from manufacturing to healthcare. The robotics market is booming, and investors can benefit from the enormous potential of robotics stocks. According to Market Research Future, the global robotics market should reach more than $286 billion by 2032, growing at 16.7% CAGR. A number of different AI technologies, including natural language processing, machine learning and edge computing will be primary growth drivers. As robotics continues to permeate various sectors, it’s essential to look deeper into the individual companies shaping this industry. Now, let’s discover the top robotics stocks to buy to make early investors filthy rich! Intuitive Surgical (ISRG) Source: Sundry Photography / Shutterstock.com Intuitive Surgical (NASDAQ: ISRG ) is a pioneer and dominant player in the surgical robotics field. The company’s flagship da Vinci surgical system has revolutionized minimally invasive surgery. Intuitive Surgical’s business model is highly successful and scalable.

Baron Funds, an investment management company, released its “Baron Health Care Fund” first quarter 2024 investor letter. A copy of the same can be downloaded here. The fund advanced 8.92% (Institutional Shares) in the quarter compared to an 8.52% gain for the Russell 3000 Health Care Index (benchmark) and a 10.56% increase for the S&P […]

Medical device company Intuitive Surgical, Inc. (NASDAQ: ISRG) announced operating results for the first quarter of 2024, reporting higher revenues and adjusted profit. First-quarter net profit, excluding one-off items, increased […] The post ISRG Earnings: Intuitive Surgical reports higher Q1 revenue and profit first appeared on AlphaStreet .

Decoding Intuitive Surgical Inc (ISRG): A Strategic SWOT Insight

Intuitive Surgical (ISRG) Surpasses Q1 Earnings, Faces Supply Challenges

Robotics stocks have been making incredible strides, transforming industries as diverse as healthcare, manufacturing and human capital management. As robots become smarter and more capable, the demand for robotics solutions will continue to soar. While the future is always uncertain, the potential of the robotics industry is undeniable. From self-driving cars to advanced surgical systems, the world is rapidly embracing robotics innovation. Investors eyeing long-term growth opportunities continue to closely monitor these companies, recognizing their potential to deliver outsized returns over the next decade. Now, let’s unpack the top robotics stocks on pace to triple by 2030! Nvidia (NVDA) Source: Below the Sky / Shutterstock.com Nvidia (NASDAQ: NVDA ) is at the forefront of the robotics revolution. The company’s graphic processing units (GPUs) are the powerhouse behind many advanced AI and machine learning applications. Nvidia is heavily invested in developing software platforms and tools specifically for robotics applications.

Make the most of a modest investment by putting it into Intuitive Surgical, Bristol Myers Squibb, and Novo Nordisk.

Intuitive Surgical Inc (NASDAQ: ISRG ) reported better-than-expected results for its first quarter on Thursday . Intuitive Surgical reported first-quarter revenue of $1.89 billion, which beat the consensus estimate of $1.87 billion, according to Benzinga Pro . The robotic-assisted surgery company''s top-line results were up 11% on a year-over-year basis. Intuitive Surgical reported quarterly adjusted earnings of $1.50 per share, which beat analyst estimates of $1.41 per share. Intuitive Surgical''s da Vinci surgical system installed base totaled … Full story available on Benzinga.com

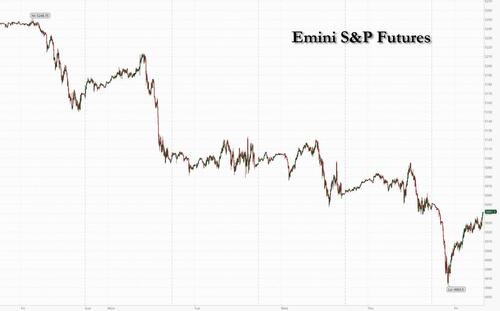

Futures Reverse All Losses, Oil Slides After Iran Plays Down Israeli Attacks, Signals No Retaliation While US futures are still modestly in the red, they are not only well off the worst overnight levels, but they are almost unchanged since yesterday''s close following a performative Israeli retaliation. which followed a performative Iranian attack, which appears to be the end of the story. For those who missed it, early on Friday local time, explosions echoed over an Iranian city on Friday in what sources described as an Israeli attack, but Tehran played down the incident and indicated it had no plans for retaliation - a response that appeared gauged towards averting region-wide war. The limited scale of the attack and Iran''s muted response both appeared to signal a successful effort by diplomats who have been working round the clock to avert all-out war since an Iranian drone and missile attack on Israel last Saturday. And so, after a whole lot of nothing overnight, as of 730am, S&P futures are practically unchanged at 5,045, Brent is actually lower compared to Thursday''s close after briefly rising above $90 earlier, gold is unchanged, bonds are modestly firmer though have pared the majority of the overnight advances, and bitcoin is higher after aggressively dumping late on Thursday.