Stryker is one of the world's leading medical technology companies and, together with its customers, is driven to make healthcare better. The company offers innovative products and services in Orthopaedics, Medical and Surgical, and Neurotechnology and Spine that help improve patient and hospital outcomes.

Stryker is one of the world's leading medical technology companies and, together with its customers, is driven to make healthcare better. The company offers innovative products and services in Orthopaedics, Medical and Surgical, and Neurotechnology and Spine that help improve patient and hospital outcomes.

2825 Airview Blvd

Portage, Michigan 49002-1802

Phone: 12693892600

www.stryker.com

Baron Funds, an investment management company, released its “Baron Health Care Fund” first quarter 2024 investor letter. A copy of the same can be downloaded here. The fund advanced 8.92% (Institutional Shares) in the quarter compared to an 8.52% gain for the Russell 3000 Health Care Index (benchmark) and a 10.56% increase for the S&P […]

https://www.investing.com/news/company-news/stryker-shares-receive-positive-stance-outperform-rating-93CH-3389289

Fearing its Stryker armored vehicles risked being outgunned, the US Army rushed to arm them with a 30-mm autocannon.

The US Army moved fast to arm its Stryker armored vehicles with a powerful autocannon. The 30mm gun would even the odds with Russian and Chinese troop carriers. But the Army put in a large order before ensuring the first turrets worked properly. Fearing that its Stryker armored vehicles were outgunned by Russian and Chinese designs, the US Army had an idea for a quick fix: Develop an unmanned Stryker turret with a 30-mm autocannon. But cutting corners in the $1 billion project has led to hardware and software issues that mean the more lethal Strykers won''t be available until at least the end of 2024, a year later than scheduled. "In prioritizing cost savings and rapid fielding, the Army assumed additional production risks because it did not follow sound acquisition practices," according to a Government Accountability Office report . Though Army leaders said in December 2023 that software issues had been fixed , war clouds in Europe and Asia raise the prospect that Stryker units might go into battle against Russian and Chinese armored vehicles that are more heavily armed.

Stay up to date with Near Infrared Imaging Market research offered by HTF MI. Check how key trends and emerging drivers are shaping this industry growth. PUNE, MAHARASHTRA, INDIA, April 18, 2024 /EINPresswire.com/ -- The Latest Study Published …

Robotics and related technologies, such as workflow automation products, cloud services, and generative AI technology, have captivated the investing community. They have assisted in leading the overall market higher over this past year especially. Investors are very interested in technology companies focused on innovation and the rollout of brand-new products and services. With the technology sector booming, it’s a perfect time for investors to jump into these robotics companies with a great future ahead of them. These stocks offer robotics technology for varying uses and have the potential for consistent growth. Investors should consider these robotics stocks to start gaining exposure to this developing industry. UiPath (PATH) Source: dennizn / Shutterstock.com UiPath (NYSE: PATH ) operates an automation platform based on robotic and generative AI capabilities. Its services are provided for industries such as financial services, healthcare, telecom, and manufacturing. Over the past year, its share price has risen by 20%, partly due to improved earnings potential.

https://www.investing.com/news/company-news/stryker-shares-price-target-raised-by-td-cowen-citing-strong-momentum-93CH-3375313

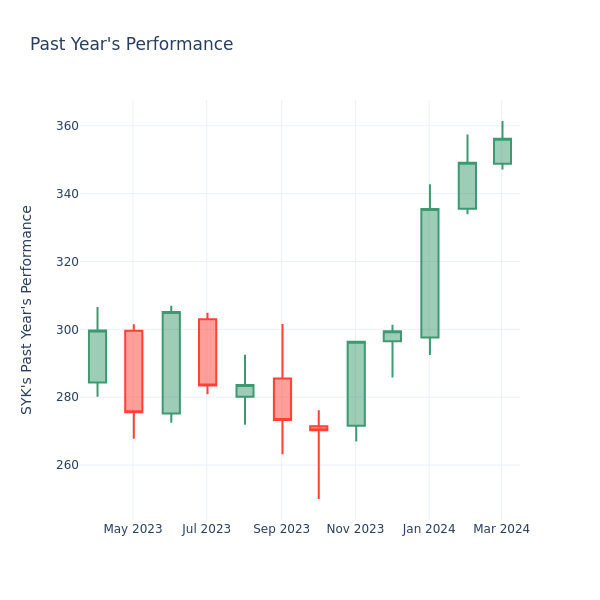

Stryker Corporation (SYK) shares are up 16% year-to-date. Medical procedures and investor demand for medical technology companies have boosted volumes.

No summary available.

In the current session, the stock is trading at $351.79, after a 0.63% spike. Over the past month, Stryker Inc. (NYSE: SYK ) stock increased by 1.24% , and in the past year, by 26.87% . With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued. How Does Stryker P/E Compare to Other Companies? The P/E ratio is used by long-term shareholders to assess the company''s market performance against … Full story available on Benzinga.com